Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Pay bills the secure way. Pay bills on time, every time – guaranteed. 1 It's safe and simple. Just tell us who, when and how much to pay. We'll take care of the rest, and our online banking security provisions and Digital Security Guarantee will protect you all the way.

- Online Bill Pay. Online bill pay is a secure, convenient way to make your monthly payment so you're always on time. All you need is your Les Schwab retail account number (shown on your statement), the phone number associated with your account, and either your bank account number or a credit/debit card number.

- Select the method you'd like to pay your bill: My Fios app To pay your bill in the My Fios app select Bill from the dashboard then select Pay Bill. Don't have the My Fios. My Verizon To pay your bill on My Verizon, sign in and: Hover over Billing select Pay Bill.

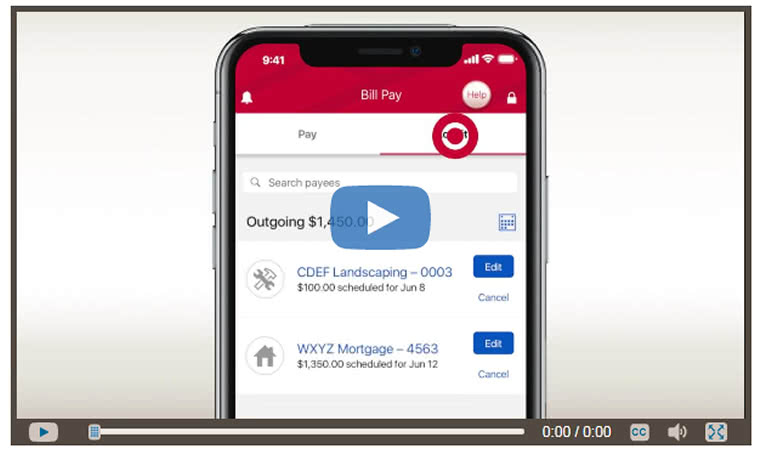

Chase Online℠ Bill Pay

Pay bills securely from virtually anywhere

- Overview

- Getting started

- FAQs

- Resources

- Pay all your bills with no fees on the Chase Mobile® app or Chase Online℠ without sharing your account details.

- With our Online Bill Payment Guarantee, your payments will be sent on the date you specify.

- Get reminders with eBills when a bill is due.

- Set up automatic bill payments on Chase Online℠.

- Easily add a payee on the Chase Mobile® app by snapping a picture of your bill or uploading a screenshot of the bill.

- Pay your bills and pay your friends from one place, no need for checks.

- Stay up to date on the status of your payments and when money leaves your account.

How to make online bill payments

Sign in to Chase Online℠ or the Chase mobile app and sign up for Chase Online Bill Pay. Choose 'Pay Bills' in the navigation menu.

Choose 'Add a payee' or 'Manage payees,' enter the requested info and complete the flow.

Once you complete the setup, you'll be ready to pay any bill or any person all in one place.

Common questions answered about Online Bill Pay

How does the Online Bill Payment Guarantee work?

expandYour payments are important to us—so important that we guarantee they'll be sent on the 'Send On' date you specify. If Chase ever delays your personal Chase Online℠ bill payment, we'll cover late fees that result from the delay if you have followed these simple guidelines:

- We receive your payment request by the Cutoff Time, sufficiently in advance of the payee's due date for the payment to arrive on time (before the interest-free period begins).

- You input the Payee information correctly.

The risk of incurring and the responsibility for paying any and all late charges or penalties shall be borne by you in the event:

- you do not follow the procedures or otherwise fail to use the Bill Payment & Transfer Service in accordance with the terms of the Online Service Agreement or

- you enter into any agreement where one of the purposes is to generate late payment fees. Our guarantee does not cover errors made by your payee or your payee's change to a delivery method that increases processing time for your payments.

How does paying bills online work?

expand

With Online Bill Pay you can pay and manage your bills in one place. Pay virtually anyone—your utilities, credit cards, even your landscaper. Free poker online. Payments are secure, and you can schedule a one-time or repeating payment while eliminating the need for postage.

Depending on the type of payee, your payment will be made electronically (delivered in 1 or 2 days) or by paper check (delivered in 5 days). We'll make payments to your Chase payees the same day if you schedule them before the Online Bill Pay cutoff time.

With eBills, you can get your statements delivered right to the Chase Mobile® app or Chase Online℠.

How do I schedule one-time payments?

expandSign in to Chase Online℠ or the Chase Mobile® app and choose 'Pay bills' then 'Schedule payment' in the navigation menu. Choose your payee, enter the amount, 'Pay from' account and the 'Send on' or 'Deliver by' date, then verify your details and submit. You'll see a payment confirmation where you can save or share your payment receipt.

Does it cost anything to pay bills online?

expandNo, there's no additional cost to use Online Bill Pay.

What's an eBill?

expandOnce you're enrolled in Online Bill Pay, you can sign up to get eBills which is an electronic version of the paper bill or statement you receive each month from any company including telecom, utilities or retailers. The electronic bill will include all the same details and information your paper bill contains.

How do I sign up for eBills?

expandOnce you're enrolled in Online Bill Pay, go to the Schedule payment screen where you'll see the payees eligible for eBills. Follow the enrollment process to enroll your payee into eBills.

How do I add a payee with a picture on the Chase Mobile® app?

expandSign into the Chase Mobile® app and choose 'Pay bills,' then 'Manage payees' in the Navigation menu. Tap 'Add a payee.' Input your payee name in the Search field and a list of potential matches will appear as well as the option to add manually. After selecting to 'add manually' or choose a 'Potential match,' tap on 'Add payee with a picture of your bill' and complete the flow by either snapping a picture of your bill or uploading a screenshot of your bill.

How do I set up Automatic bill payments on Chase Online℠?

expandSign in to Chase Online℠ and choose 'Pay & Transfers,' then choose 'Payment Activity.' From there choose 'Automatic payments' under 'Bill Pay' in the side menu; choose 'Set up an automatic payment' and complete the flow. Please add your desired payee before setting up automatic payments.

What's new with Online Bill Pay?

expandYou can now add a payee for online bill payments by taking a picture of your bill or uploading a screenshot of your bill with the Chase Mobile® app and we'll fill in the payee details. You can also set up automatic bill payments for the eBills you have set up—choose the amount, frequency and date when you want us to send the payment. Continue to manage all of your payments from one place, whether it's to your friend using Chase QuickPay® with Zelle® or your mobile phone bill. You can take action on your upcoming Chase credit card payments, eBills and Chase QuickPay® with Zelle® requests all in one place. You can also stay updated on the status of your payments and when money leaves your account.

Have more questions?

24/7 access to deposit funds

- Chase QuickDeposit℠ — Securely deposit checks from almost anywhere.

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs.

- Direct deposit — Automatically deposit paychecks.

Pay bills quickly & conveniently

- Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Chase QuickPay® with Zelle® — Send and receive money from almost anyone with just a mobile number or email address.

Helpful technology that saves you time and keeps you in the know

- Paperless statements — Digitally access up to 7 years of statements.

- Account alerts — Monitor finances, avoid overdrafts and more.

- Chase text banking — Check balances and transaction history with a text.

What's the best and safest way to pay your credit card bill? Should you pay your credit card bill via mail, online (the internet), or on the telephone (phone)?

In this article, I'm going to tell you how I pay my credit card bills, and also the best and safest option to pay your bill on time every month.

Best Ways to Pay Credit Cards

The three most common ways people use to pay off their credit cards are

- Mail: In this method, you usually mail in a check or money order to pay your monthly credit card statement.

- Internet: Some people choose to pay online by using a savings or checking account number, or another type of online transaction.

- Phone: Others may still prefer to pay via phone. With this method, a checking or savings account number is usually given over the phone (either to a customer service agent, or an automated system).

So which method is safest to use? Which one is the best to use? Here are the pros and cons of each:

Pros and Cons of Paying via Mail:

The pros of paying your credit card via mail is:

- No internet connection or phone required–some people don't have an internet connection or a home phone.

- No risk of internet hacking, or phone scanners picking up your information.

- Convenience: Simply walk to your mailbox and drop the check in the mail

Cons of paying your credit card via mail:

- Delays or lost mail: If your mail is lost or delayed, it could cause your bill to be late. This could raise your interest rates, hurt your credit report, and more. I've had my mail payments delayed or lost in the past.

- Theft: Mail theft still happens, and someone may try to steal your credit card number or banking information if they steal your payment information in the mail.

- Stamps: You generally have to pay postage, and while this isn't a significant expense, it is worth considering.

Pros and Cons of Paying via Phone:

Pros of paying your credit card over the phone:

- Payments usually post the same day, or the very next day, thus there is little risk of payments being late as long as you pay on time.

- No internet or postage required. Simply call on the telephone and make the payment using electronic checking information.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Pay bills the secure way. Pay bills on time, every time – guaranteed. 1 It's safe and simple. Just tell us who, when and how much to pay. We'll take care of the rest, and our online banking security provisions and Digital Security Guarantee will protect you all the way.

- Online Bill Pay. Online bill pay is a secure, convenient way to make your monthly payment so you're always on time. All you need is your Les Schwab retail account number (shown on your statement), the phone number associated with your account, and either your bank account number or a credit/debit card number.

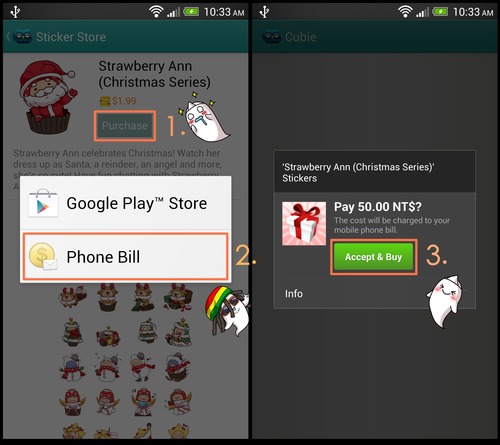

- Select the method you'd like to pay your bill: My Fios app To pay your bill in the My Fios app select Bill from the dashboard then select Pay Bill. Don't have the My Fios. My Verizon To pay your bill on My Verizon, sign in and: Hover over Billing select Pay Bill.

Chase Online℠ Bill Pay

Pay bills securely from virtually anywhere

- Overview

- Getting started

- FAQs

- Resources

- Pay all your bills with no fees on the Chase Mobile® app or Chase Online℠ without sharing your account details.

- With our Online Bill Payment Guarantee, your payments will be sent on the date you specify.

- Get reminders with eBills when a bill is due.

- Set up automatic bill payments on Chase Online℠.

- Easily add a payee on the Chase Mobile® app by snapping a picture of your bill or uploading a screenshot of the bill.

- Pay your bills and pay your friends from one place, no need for checks.

- Stay up to date on the status of your payments and when money leaves your account.

How to make online bill payments

Sign in to Chase Online℠ or the Chase mobile app and sign up for Chase Online Bill Pay. Choose 'Pay Bills' in the navigation menu.

Choose 'Add a payee' or 'Manage payees,' enter the requested info and complete the flow.

Once you complete the setup, you'll be ready to pay any bill or any person all in one place.

Common questions answered about Online Bill Pay

How does the Online Bill Payment Guarantee work?

expandYour payments are important to us—so important that we guarantee they'll be sent on the 'Send On' date you specify. If Chase ever delays your personal Chase Online℠ bill payment, we'll cover late fees that result from the delay if you have followed these simple guidelines:

- We receive your payment request by the Cutoff Time, sufficiently in advance of the payee's due date for the payment to arrive on time (before the interest-free period begins).

- You input the Payee information correctly.

The risk of incurring and the responsibility for paying any and all late charges or penalties shall be borne by you in the event:

- you do not follow the procedures or otherwise fail to use the Bill Payment & Transfer Service in accordance with the terms of the Online Service Agreement or

- you enter into any agreement where one of the purposes is to generate late payment fees. Our guarantee does not cover errors made by your payee or your payee's change to a delivery method that increases processing time for your payments.

How does paying bills online work?

expandWith Online Bill Pay you can pay and manage your bills in one place. Pay virtually anyone—your utilities, credit cards, even your landscaper. Free poker online. Payments are secure, and you can schedule a one-time or repeating payment while eliminating the need for postage.

Depending on the type of payee, your payment will be made electronically (delivered in 1 or 2 days) or by paper check (delivered in 5 days). We'll make payments to your Chase payees the same day if you schedule them before the Online Bill Pay cutoff time.

With eBills, you can get your statements delivered right to the Chase Mobile® app or Chase Online℠.

How do I schedule one-time payments?

expandSign in to Chase Online℠ or the Chase Mobile® app and choose 'Pay bills' then 'Schedule payment' in the navigation menu. Choose your payee, enter the amount, 'Pay from' account and the 'Send on' or 'Deliver by' date, then verify your details and submit. You'll see a payment confirmation where you can save or share your payment receipt.

Does it cost anything to pay bills online?

expandNo, there's no additional cost to use Online Bill Pay.

What's an eBill?

expandOnce you're enrolled in Online Bill Pay, you can sign up to get eBills which is an electronic version of the paper bill or statement you receive each month from any company including telecom, utilities or retailers. The electronic bill will include all the same details and information your paper bill contains.

How do I sign up for eBills?

expandOnce you're enrolled in Online Bill Pay, go to the Schedule payment screen where you'll see the payees eligible for eBills. Follow the enrollment process to enroll your payee into eBills.

How do I add a payee with a picture on the Chase Mobile® app?

expandSign into the Chase Mobile® app and choose 'Pay bills,' then 'Manage payees' in the Navigation menu. Tap 'Add a payee.' Input your payee name in the Search field and a list of potential matches will appear as well as the option to add manually. After selecting to 'add manually' or choose a 'Potential match,' tap on 'Add payee with a picture of your bill' and complete the flow by either snapping a picture of your bill or uploading a screenshot of your bill.

How do I set up Automatic bill payments on Chase Online℠?

expandSign in to Chase Online℠ and choose 'Pay & Transfers,' then choose 'Payment Activity.' From there choose 'Automatic payments' under 'Bill Pay' in the side menu; choose 'Set up an automatic payment' and complete the flow. Please add your desired payee before setting up automatic payments.

What's new with Online Bill Pay?

expandYou can now add a payee for online bill payments by taking a picture of your bill or uploading a screenshot of your bill with the Chase Mobile® app and we'll fill in the payee details. You can also set up automatic bill payments for the eBills you have set up—choose the amount, frequency and date when you want us to send the payment. Continue to manage all of your payments from one place, whether it's to your friend using Chase QuickPay® with Zelle® or your mobile phone bill. You can take action on your upcoming Chase credit card payments, eBills and Chase QuickPay® with Zelle® requests all in one place. You can also stay updated on the status of your payments and when money leaves your account.

Have more questions?

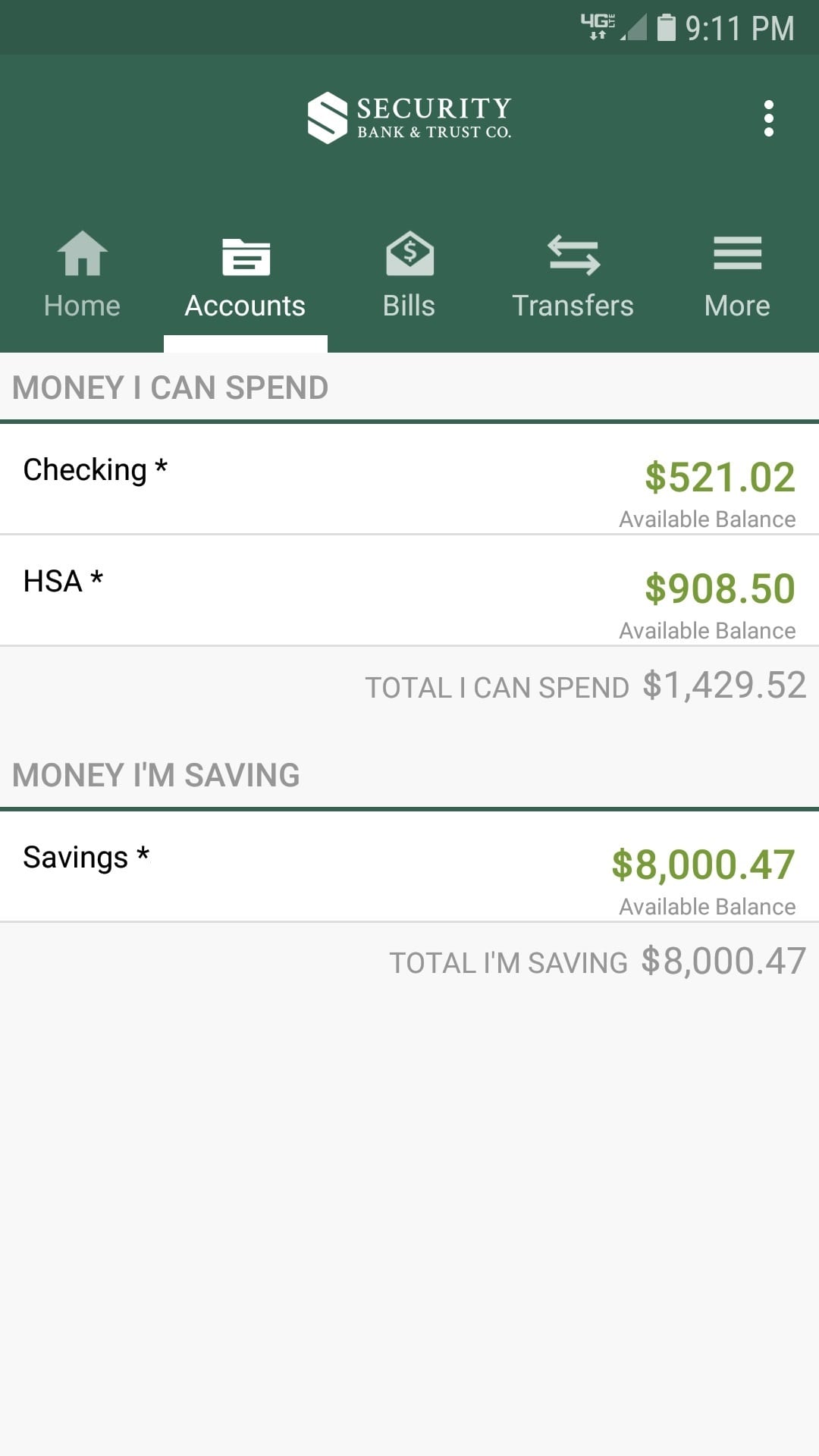

24/7 access to deposit funds

- Chase QuickDeposit℠ — Securely deposit checks from almost anywhere.

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs.

- Direct deposit — Automatically deposit paychecks.

Pay bills quickly & conveniently

- Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Chase QuickPay® with Zelle® — Send and receive money from almost anyone with just a mobile number or email address.

Helpful technology that saves you time and keeps you in the know

- Paperless statements — Digitally access up to 7 years of statements.

- Account alerts — Monitor finances, avoid overdrafts and more.

- Chase text banking — Check balances and transaction history with a text.

What's the best and safest way to pay your credit card bill? Should you pay your credit card bill via mail, online (the internet), or on the telephone (phone)?

In this article, I'm going to tell you how I pay my credit card bills, and also the best and safest option to pay your bill on time every month.

Best Ways to Pay Credit Cards

The three most common ways people use to pay off their credit cards are

- Mail: In this method, you usually mail in a check or money order to pay your monthly credit card statement.

- Internet: Some people choose to pay online by using a savings or checking account number, or another type of online transaction.

- Phone: Others may still prefer to pay via phone. With this method, a checking or savings account number is usually given over the phone (either to a customer service agent, or an automated system).

So which method is safest to use? Which one is the best to use? Here are the pros and cons of each:

Pros and Cons of Paying via Mail:

The pros of paying your credit card via mail is:

- No internet connection or phone required–some people don't have an internet connection or a home phone.

- No risk of internet hacking, or phone scanners picking up your information.

- Convenience: Simply walk to your mailbox and drop the check in the mail

Cons of paying your credit card via mail:

- Delays or lost mail: If your mail is lost or delayed, it could cause your bill to be late. This could raise your interest rates, hurt your credit report, and more. I've had my mail payments delayed or lost in the past.

- Theft: Mail theft still happens, and someone may try to steal your credit card number or banking information if they steal your payment information in the mail.

- Stamps: You generally have to pay postage, and while this isn't a significant expense, it is worth considering.

Pros and Cons of Paying via Phone:

Pros of paying your credit card over the phone:

- Payments usually post the same day, or the very next day, thus there is little risk of payments being late as long as you pay on time.

- No internet or postage required. Simply call on the telephone and make the payment using electronic checking information.

Cons of paying via phone:

- Neighbors with scanners could listen in (unless you use a secured landline).

- Some credit cards charge a fee or surcharge to pay via phone, which could be as much as $10 or more.

- It could be a hassle dealing with customer service people, or going through an automated menu each month.

Comcast Pay Bill Via Phone

Pros and Cons of Paying via Internet (Online)

Pros of paying your credit card via the Internet:

- Instant payment posting (as long as you pay before a certain time of day, usually 4 or 5 pm)

- Ability to schedule payment posting dates. You can schedule payments to post on certain days.

- Little to no risk of payment being delayed or not posting on time (as long as you pay or schedule before hand).

- Usually no fees or postage to deal with (unless your bank charges a fee, but this would be rare).

Cons of paying your credit card via the Internet:

- Usually have to enter your checking or savings account information one time (which could potentially be hacked)

- Some people don't have an internet connection.

- Will have to keep up with account passwords and security.

So What's the Best Way to Pay Your Credit Card Bill?

As a long-time credit card user, I've used all of the above methods. I used to mail in all of my statements. I've had to make a few phone payments, and I also have used the internet. So which one do I prefer?

The internet by a long shot. Not only is it more convenient, but I really like accessing my credit card online. I can view my cashback status, schedule payments, see recent transactions, and more.

Is there a chance it could be hacked? Yes, but the cool thing is that to pay my card, I only have to enter my bank information one time. After that, I simply schedule my payment and hit 'pay bill.' So while there is always a chance data can get hacked, it has been safe for me for the past 8 years or so.

Not to mention that there are also risks with mailing or phoning in a payment as well. Unfortunately, you can never escape risks 100% when dealing with credit cards. But if you use good practices, either method will work.

Pay Att Bill Via Phone

But hands down, I prefer to pay my credit card bills and view my account activity online. It's much faster, easier, and I enjoy staying on top of my finances.